Well, perhaps never but the country should not have joined in the first place; a view that provides strong lessons for Latvia.

This summer I visited VW’s Autostadt in Wolfsburg and saw, among many other cars, a beautiful Lancia Lambda from 1924. Price at that time: 35,000 lire. When Italy joined the Eurozone in 1999 the conversion rate for the lira was 1932 to the euro or about 18 of today’s euro for that fine car. A simple example of Italy as a perennial high-inflation country, which had to resort time and again to currency devaluation to maintain competitiveness.

In the Eurozone currency devaluation is by definition impossible so countries should only join if they obey inflation discipline – but some countries so obviously joined with a rather relaxed attitude towards the importance of cost and price competitiveness and they are now paying a hefty price for the mistake of joining the euro. Some graphs and data should illustrate this.

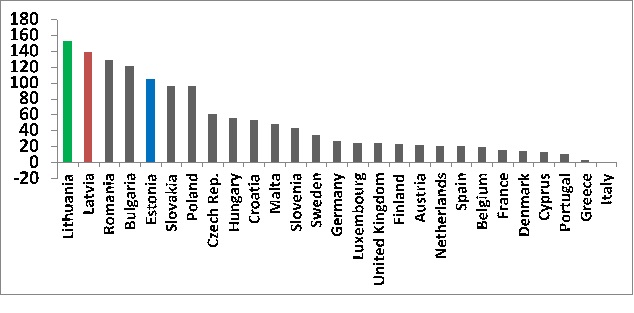

Take the development in incomes since the inception of the Eurozone in 1999 as illustrated in Figure 1 with GDP per person. Incomes in Latvia have risen a tremendous 138% – in constant prices, i.e. with inflation taken into account. Lithuania has done even better and the best performers are from Eastern Europe, which is not strange; it is part of the income convergence story. The poor performers are in Europe’s south. Italy stands out – its average income per person today, almost 20 years after the formation of the Eurozone, is lower than upon entry. 20 years – and Italians are poorer today than when they joined. Economic failure on a rather epic scale (harsh words, perhaps, but this is really seldom seen over such a long period of time).

Figure 1: GDP per capita change in constant prices, 1999 – 2017, EU28 minus Ireland

Source: Eurostat plus own calculations

Note: Ireland is omitted due to its change of GDP calculation.

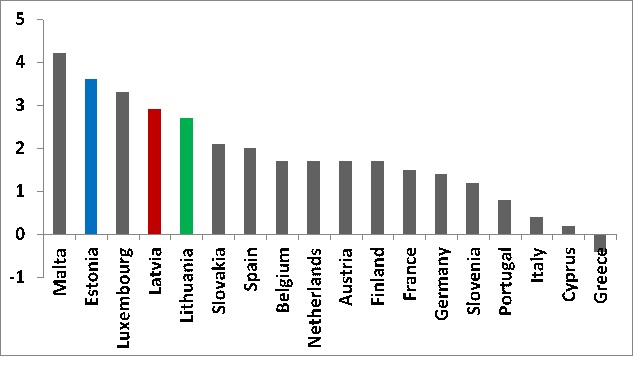

In Figure 2 I portray the average growth rate of the Eurozone countries since they joined the single currency (so the number for Latvia is based on four years only (2014-2017) and should thus be interpreted carefully but the period was not one of extraordinary developments, positive or negative, so I chose to include this data also). The data is for the overall economy thus not per capita – this explains better the development of activity in the economy.

Again, the Baltics look good; so does Malta and Luxembourg, both also well-helped by population increase. Greece, another failure, has a smaller economy today than when it joined in 2002 while Italy, with average growth at a snail’s pace of 0.4% per year, performs dismally also here.

Figure 2: Average annual growth rate since joining the Eurozone

Source: Eurostat and own calculations

Austria, Belgium, Finland, France, Germany, Ireland, Italy Luxembourg, Netherlands, Portugal and Spain joined in 1999, Greece in 2002, Slovenia 2007, Cyprus and Malta 2008, Slovakia 2009, Estonia 2011, Latvia 2014 and Lithuania 2015.

Note: Ireland omitted for the same reasons as for Figure 1

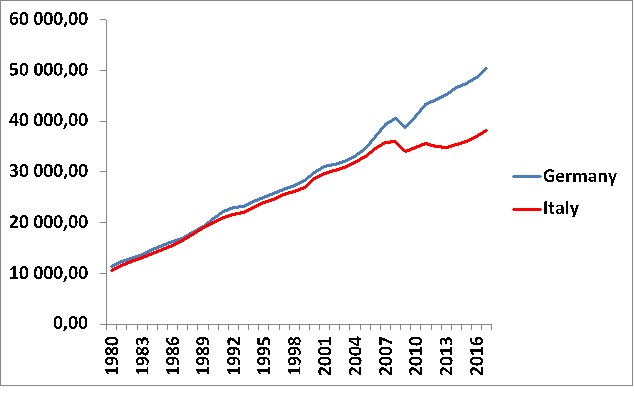

But perhaps the most damning display of Italy’s lack of economic performance is in Figure 3. It shows income per person in Germany and Italy; it is not inflation-adjusted but this is not necessary since comparisons should be made year by year. The IMF allows me data from 1980 and what can be seen is that Italy and Germany were roughly at the same level of income per person – equally rich – until a bit into the 2000s. Since then a gap of no less than 32% has built up. Germany is super-qualified for the Eurozone: Eminent at cost control and productivity increases. Italy is not. How long will Italians accept this failure?

Figure 3: GDP per capita in current USD, Germany and Italy, 1980 – 2017. Adjusted for purchasing power.

Source: IMF

Italians have done something but not necessarily for their own long-term benefit by electing a government that includes the 5-Star Movement that sometimes is in favour of leaving the euro, sometimes not (???). The new government seems in favour of lower taxes and more government spending to increase economic growth – an excellent suggestion if the country was not already burdened by budget deficits and a level of debt of around 120% of GDP.

If a country fails to promote competitiveness, fails at cost control, fails at increasing productivity and thus needs the possibility of currency devaluation to promote competitiveness it should never join a common currency.

Italy made all these mistakes and is paying a tremendous price for this, year after year.

The lessons for Latvia are so obvious they need not even be listed.

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and a member of the Fiscal Discipline Council.

Points of view expressed here are my own and not necessarily those of the Fiscal Discipline Council.

Pagaidām nav neviena komentāra