Need a break from banks and bankers? Then take a look at some graphs here!

In the fourth quarter of 2017 Latvia, to rather little fanfare, finally clawed back the GDP it lost in the financial crisis. Prior to the crisis, the Latvian economy peaked in third quarter of 2007 (as the first of the EU economies), bottomed out in the third quarter of 2010 with GDP down an accumulated 23%, then resumed growth and then, in the fourth quarter of 2017, reached its level of Q3 2007. Ten years (and one quarter) later.

Ten lost years?

Yes and no (as is always the answer in economics…) – one can argue that the level of economic activity in 2007 was unsustainably high with unemployment pushed to never-again-seen low levels and some of the activity was, with hindsight, crazy construction.

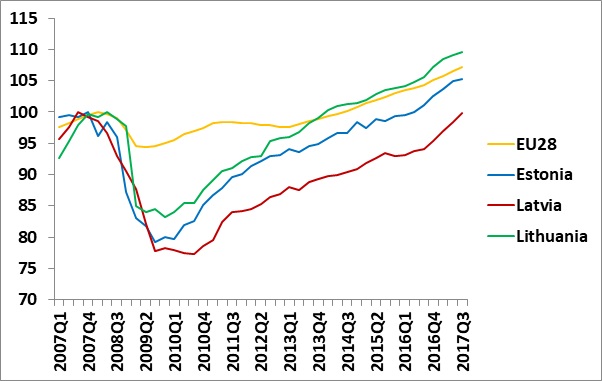

Then again, the numbers don’t lie – Figure 1 tells the story for the Baltics and the EU. Latvia was hit harder and longer than its two Baltic neighbours and has taken longer to recover lost territory – the result of a bigger boom in credit, real estate and pro-cyclical fiscal policy prior to the crisis.

Figure 1: GDP development since peak before the financial crisis, EU28, and the Baltics

Source: Eurostat and own calculations

Note: The peak before the ensuing recession was reached in Q4 2007 (Estonia), Q3 2007 (Latvia), Q2 2008 (Lithuania) and Q1 2008 (EU28)

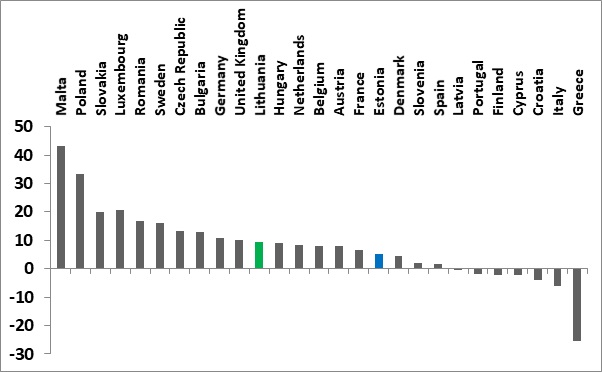

Figure 2 tells the story for all the countries in the EU by depicting the change in GDP since each country’s peak before the financial crisis (all countries, bar Poland, see note, peaked between Q3 2007 and Q4 2008, the last countries to be hit being Bulgaria and the Netherlands). Latvia, despite decent growth after the financial crisis is still among the laggards.

Figure 2: GDP growth since the country’s peak before the financial crisis

Source: Eurostat and own calculations

Note: Poland, as the only EU country, never went into recession and thus never peaked. I have used Q2 2008 for comparison.

Note: Ireland is excluded due to changes in their GDP calculations.

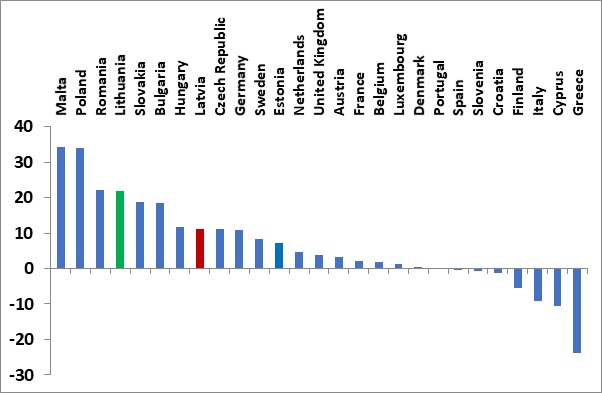

Some will claim that this does not take into account the changes in population and in particular employment in the different countries since demographics and migration flows have shifted employment across Europe. OK, then look at Figure 3. It does the same trick as Figure 2 but for GDP per person.

Here the result is more flattering for Latvia but although this represents much-needed productivity gains, I find it hard to celebrate an improvement in GDP per capita over GDP in general coming from a high level of outward migration…..

Figure 3: Growth of GDP per capita since the country’s peak before the financial crisis

Source: Eurostat and own calculations

The conclusion to draw might be banal but is nevertheless important: Don’t get into a credit-, real estate- and construction boom in the first place. Here policy definitely failed in Latvia but hopefully won’t do so again.

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and a member of the Fiscal Discipline Council of Latvia

Points of view expressed here are not necessarily those of the Fiscal Discipline Council

Komentāri (1)

Sergejs Zaicevs 25.03.2018. 17.41

The conclusion is banal indeed. And yes, important indeed.

However, one can argue, that the deepest in the EU contruction of Latvian GDP has followed (and to big extent was a result of) the biggest in the EU GDP growth before 2007. And what happened during the last 10 years – is a substitution of construction and real estate overweighted economy with more sustainable GDP composition, better balanced among industries.

What is more interesting to see is how far the EU (eastern EU in particular) economies has progressed in GDP-per-capita terms since 2001 or 2002, right before easy credit started to flow into those economies. Who managed to turn last 15-16 years into “a catch up western EU living standards” exercise despite booms and busts and booms again and who did not. And why? And are big GDP fluctuations necessarily a bad thing in the longer run GDP expansion.

0